How to Calculate Rent for a House

Understanding Rental Market Factors

How to calculate rent for house – Accurately calculating rent requires a thorough understanding of the local rental market. Several key factors significantly influence rental rates, and ignoring them can lead to inaccurate pricing and potentially lost revenue.

Location’s Impact on Rental Rates

Location is arguably the most crucial factor affecting rental prices. Properties in desirable areas with good schools, low crime rates, convenient amenities, and easy access to transportation command higher rents. Conversely, properties in less desirable locations typically rent for less. The proximity to employment centers, entertainment venues, and public transportation also plays a significant role.

Property Size and Features Influence on Rental Costs

The size of a property, the number of bedrooms and bathrooms, and the presence of desirable features directly impact rental value. Larger properties with updated kitchens, modern bathrooms, in-unit laundry, and other amenities typically command higher rents than smaller, less updated properties. The overall condition and quality of finishes also play a significant role.

Rental Rate Comparison for Similar Properties in Different Neighborhoods

Comparing rental rates for similar properties in different neighborhoods provides valuable insights into market variations. For example, a three-bedroom house in a wealthy suburb will likely rent for significantly more than an identical property in a less affluent area, even if the properties are comparable in size and condition. This comparison helps establish a realistic rental range for a given property.

Market Demand and Supply’s Effect on Rental Prices

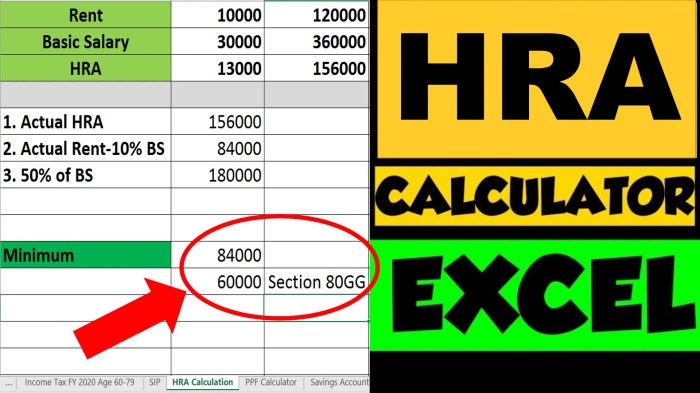

Source: fincalc-blog.in

The interplay of supply and demand heavily influences rental rates. In areas with high demand and low supply, rental prices tend to be higher. Conversely, in areas with high supply and low demand, rental prices may be lower. Seasonal fluctuations in demand can also impact rental rates.

Rental Rates for Different Property Types in a Specific Location

The following table illustrates sample rental rates for different property types in a hypothetical location (e.g., a mid-sized city in the US). These are illustrative figures and actual rates may vary significantly based on the specific property and market conditions.

| Property Type | Average Monthly Rent | Range | Notes |

|---|---|---|---|

| Studio | $1200 | $1000 – $1400 | Depending on amenities and location within the city. |

| 1-Bedroom | $1500 | $1300 – $1700 | Similar to studios, but with more space. |

| 2-Bedroom | $1800 | $1600 – $2000 | Larger space and more suitable for families. |

| 3-Bedroom | $2200 | $2000 – $2400 | Most suitable for larger families. |

Calculating Rent Based on Property Value

Another approach to determining rent is to base it on the property’s market value. This method involves estimating the property’s worth and then applying a capitalization rate to determine the potential rental income.

Methods for Estimating Market Value

Several methods exist for estimating a house’s market value. These include conducting a comparative market analysis (CMA) by researching recently sold comparable properties in the area, using online property valuation tools, and consulting with a real estate appraiser for a professional opinion. Each method offers different levels of accuracy and detail.

Approaches to Calculating Rental Income Based on Property Value

One common approach is using the capitalization rate (Cap Rate). The Cap Rate is the ratio of net operating income (NOI) to the property value. It’s expressed as a percentage. For example, a property with a $200,000 value and a $20,000 NOI has a 10% Cap Rate ($20,000/$200,000 = 0.10 or 10%). Investors often use this rate to estimate potential rental income.

By rearranging the formula, one can estimate potential rental income by multiplying the Cap Rate by the property value.

Role of Appreciation and Depreciation in Rental Calculations

Property value appreciation increases the property’s worth over time, while depreciation represents the decrease in value due to age and wear and tear. Both factors should be considered when projecting long-term rental income. Appreciation generally increases potential rental income, while depreciation may necessitate adjustments to rental calculations or increase maintenance expenses.

Formula for Calculating Potential Rental Income from Property Value

A simplified formula for calculating potential rental income is:

Potential Rental Income = Property Value x Cap Rate

It’s crucial to remember that this is a simplified calculation and doesn’t account for all expenses.

Adjusting Rental Income Based on Property Condition and Needed Repairs

The condition of the property significantly impacts rental income. Properties requiring significant repairs or renovations may command lower rents until the necessary improvements are made. Conversely, properties in excellent condition with modern amenities may command higher rents. Landlords should factor in the cost of repairs and maintenance when setting rental prices.

Considering Expenses and Profitability

Accurately calculating rental income requires a detailed understanding of all associated expenses. Failing to account for all costs can lead to inaccurate projections and potentially financial losses.

Common Expenses Associated with Renting Out a House

Common expenses include property taxes, insurance premiums (hazard and liability), property management fees (if applicable), maintenance and repairs, utilities (if paid by the landlord), and vacancy costs (periods when the property is not rented). Understanding these expenses is critical for accurate budgeting.

Calculating Net Operating Income (NOI)

Net Operating Income (NOI) is a key metric in real estate investment. It’s calculated by subtracting all operating expenses from the total rental income. A higher NOI indicates greater profitability. The formula is:

NOI = Total Rental Income – Total Operating Expenses

Methods for Budgeting for Potential Rental Property Expenses

Several budgeting methods can be employed. One approach is to create a detailed annual budget that accounts for all anticipated expenses. Another is to use historical data from similar properties to estimate expenses. A third is to use a percentage of rental income to estimate expenses (e.g., allocating 50% of rental income for expenses). The choice of method depends on available data and the landlord’s risk tolerance.

List of Unexpected Expenses a Landlord Might Encounter

Unexpected expenses can significantly impact profitability. Examples include major appliance failures, plumbing issues, roof repairs, and legal fees. Setting aside a reserve fund for unexpected repairs is prudent.

Sample Rental Property Budget

The following table provides a sample rental property budget. Remember, these are illustrative figures, and actual expenses will vary based on the specific property and location.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Rent | $2000 | Property Taxes | $200 |

| Insurance | $100 | ||

| Maintenance | $150 | ||

| Utilities (if paid by landlord) | $100 | ||

| Property Management (if applicable) | $200 | ||

| Total Annual Income | $24000 | Total Annual Expenses | $7500 |

| Net Operating Income (NOI) | $16500 |

Legal and Regulatory Considerations

Landlords must adhere to all applicable local, state, and federal laws and regulations. Failure to do so can result in significant legal consequences.

Importance of Adhering to Local Rental Laws and Regulations

Local rental laws govern various aspects of the landlord-tenant relationship, including lease agreements, security deposits, eviction procedures, and tenant rights. Understanding and complying with these laws is essential for avoiding legal disputes and penalties.

Creating a Legally Sound Lease Agreement

Source: slidesharecdn.com

A legally sound lease agreement clearly Artikels the terms and conditions of the rental agreement. It should include details such as the rental period, rent amount, payment schedule, tenant responsibilities, landlord responsibilities, and procedures for addressing disputes. It’s advisable to consult with a legal professional to ensure the lease agreement is compliant with all applicable laws.

Landlord Responsibilities Concerning Property Maintenance and Tenant Rights

Landlords have a legal responsibility to maintain the property in a habitable condition and to respect tenants’ rights. This includes addressing necessary repairs promptly, ensuring the property complies with health and safety codes, and respecting tenants’ privacy.

Examples of Common Legal Issues Landlords May Face

Common legal issues include disputes over security deposits, lease violations, eviction proceedings, and claims of discrimination. Proactive measures such as maintaining detailed records and adhering to legal procedures can help minimize these risks.

Checklist to Ensure Compliance with Relevant Rental Laws

A comprehensive checklist should be developed to ensure compliance with all relevant laws. This checklist should include verifying local ordinances, reviewing state and federal regulations, ensuring the lease agreement is compliant, maintaining accurate records, and promptly addressing tenant concerns.

Setting a Competitive Rent Price: How To Calculate Rent For House

Setting a competitive rent price is crucial for attracting quality tenants and maximizing rental income. A well-researched and data-driven approach is essential.

Comparing Rental Rates for Similar Properties

Comparing rental rates for similar properties in the same area is fundamental to setting a competitive price. Factors to consider include property size, features, condition, and location within the neighborhood.

Using Online Rental Listings to Research Comparable Properties

Online rental listings (e.g., Zillow, Trulia, Apartments.com) provide valuable data for researching comparable properties. Analyzing these listings allows landlords to benchmark their property against similar ones in the area.

Adjusting Rental Price Based on Market Conditions and Property Features

The rental price should be adjusted based on market conditions and property features. In a strong rental market, landlords may be able to command higher rents. Properties with desirable features (e.g., updated appliances, in-unit laundry) can also justify higher rental prices.

Examples of How to Present the Rental Price Effectively to Potential Tenants

The rental price should be presented clearly and transparently in all marketing materials. It’s advisable to highlight the value proposition of the property and justify the price based on its features and location. A well-written property description that showcases its amenities and desirable aspects will help attract potential tenants.

Comparative Analysis of Rental Prices for Similar Properties

The following table provides a sample comparative analysis of rental prices for similar properties. Remember, these are illustrative figures and actual rates will vary.

| Property Address | Property Type | Monthly Rent | Key Features |

|---|---|---|---|

| 123 Main St | 3-Bedroom House | $2200 | Updated Kitchen, Large Yard |

| 456 Oak Ave | 3-Bedroom House | $2000 | Needs some repairs, smaller yard |

| 789 Pine Ln | 3-Bedroom House | $2300 | New appliances, great location |

Illustrative Examples and Case Studies

Analyzing specific examples and case studies helps illustrate the practical application of rent calculation principles and highlights potential outcomes.

Detailed Example of Calculating Rent for a Specific Property

Let’s consider a 2-bedroom house valued at $300,000 with a 5% cap rate. The estimated annual rental income would be $15,000 ($300,000 x 0.05). Assuming monthly expenses of $500 (taxes, insurance, maintenance), the annual net operating income would be $9,000 ($15,000 – $6,000). This would translate to a monthly net income of $750. This is a simplified example and does not include all potential expenses.

Case Study of a Successful Rental Property Investment

A successful case study might involve a property purchased in an up-and-coming neighborhood with strong rental demand. The landlord meticulously maintained the property, resulting in consistently high occupancy rates and minimal vacancy periods. Careful tenant selection and proactive maintenance minimized repair costs and maximized rental income.

Case Study of a Rental Property Investment That Did Not Yield Expected Returns

A case study of an unsuccessful investment might involve a property purchased in a declining neighborhood with high vacancy rates and significant repair needs. Poor tenant selection, deferred maintenance, and unforeseen repairs led to significant financial losses. This example highlights the importance of thorough due diligence and market research.

Determining your rental budget involves considering factors like income and desired amenities. To find suitable options, you might explore websites listing properties like those found when searching for houses for rent Woodstock GA. Once you’ve identified potential properties, remember to factor in additional costs such as utilities and security deposits when calculating your total monthly housing expense.

Hypothetical Scenario Demonstrating the Impact of Different Factors on Rental Profitability, How to calculate rent for house

A hypothetical scenario might compare the profitability of two identical properties in different locations. One property is located in a high-demand area with low vacancy rates, resulting in high rental income and strong profitability. The other is in a low-demand area with high vacancy rates, resulting in lower income and reduced profitability. This illustrates the significant impact of location on rental returns.

Key Steps in Determining a Fair Market Rent

- Conduct a comparative market analysis (CMA) of similar properties.

- Analyze rental listings online to benchmark against comparable properties.

- Factor in property features, condition, and location.

- Consider market conditions (supply and demand).

- Account for all potential expenses (taxes, insurance, maintenance).

- Set a price that is competitive yet profitable.

Popular Questions

What is a capitalization rate, and how is it used in rent calculation?

A capitalization rate (cap rate) is a measure of a property’s potential rate of return. It’s calculated by dividing the net operating income (NOI) by the property’s value. A higher cap rate generally indicates a higher potential return, but it also carries more risk.

How do I account for property appreciation or depreciation when calculating rent?

Appreciation (increase in value) isn’t directly factored into annual rent calculations. However, it influences the property’s overall value over time, affecting potential sale price and future rental income. Depreciation (decrease in value due to wear and tear) should be considered in budgeting for maintenance and repairs.

What are some common legal pitfalls landlords should avoid?

Common pitfalls include violating fair housing laws, failing to maintain the property in habitable condition, improperly handling security deposits, and neglecting to provide proper lease agreements.

How often should I adjust my rental rates?

Rental rates should be reviewed annually or as market conditions change significantly. Consider comparable properties in your area and local market trends when making adjustments.